- Get link

- Other Apps

The idea of cash laundering is essential to be understood for these working within the financial sector. It is a process by which dirty money is converted into clean money. The sources of the money in precise are legal and the money is invested in a approach that makes it seem like clean cash and hide the id of the prison a part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new clients or sustaining present clients the responsibility of adopting enough measures lie on each one who is part of the organization. The identification of such element to start with is easy to take care of instead realizing and encountering such conditions in a while in the transaction stage. The central financial institution in any nation offers full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such situations.

Input managements assessment of the level of risk to the bank associated with each category with 1 as low risk 3 as average risk and 5 high risk. The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions.

Bank Secrecy Act Bsa Anti Money Laundering Aml Probank Austin

Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity.

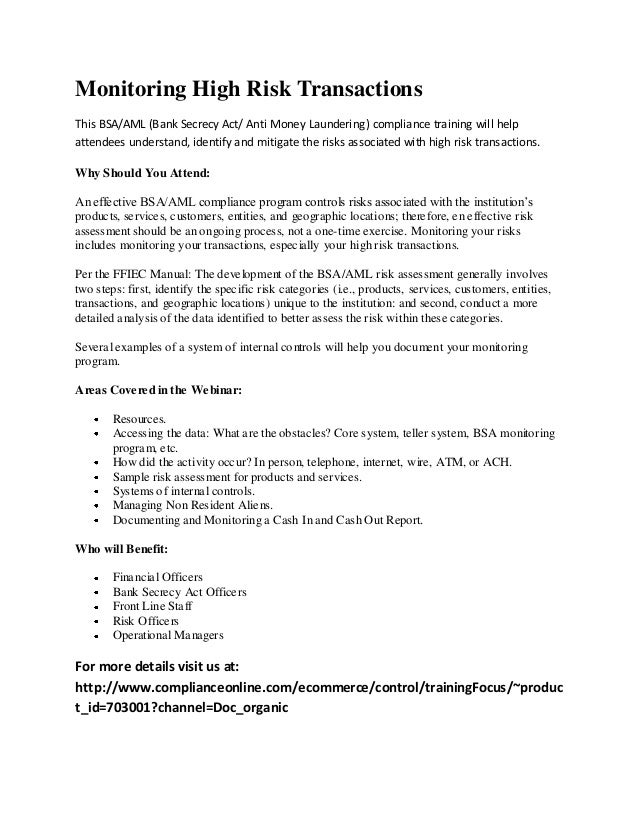

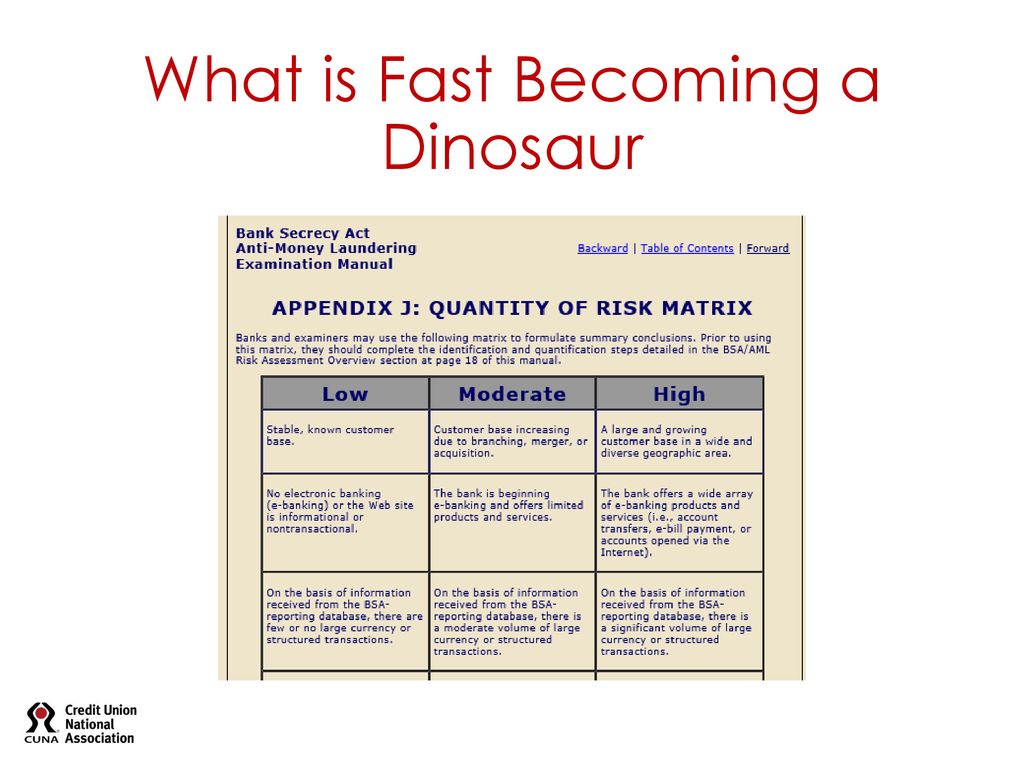

Bank secrecy act risk assessment. 0 denotes not applicable to the specific category. It is also a good practice to list high risk account types or activities in the risk assessment whether or not you are holding performing any of them. The banks BSAAML risk assessment process should address the varying degrees of risk associated with its products services customers and geographic locations as appropriate.

Though the risk assessments of a few institutions are still not analytical andor detailed enough to enable a true assessment whether the AML Program is aligned to institutions risks the overall BSAAML risk assessments. An example of the risk assessment flow is located in Appendix I pages I-1 of the manual. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate.

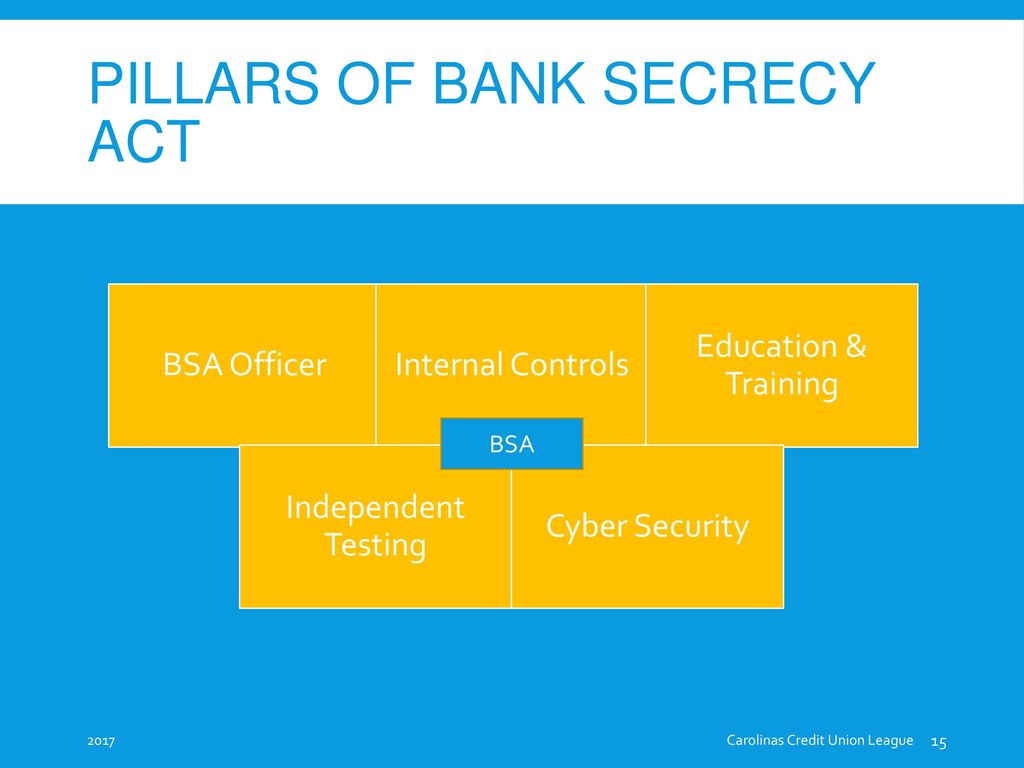

It is flexible and intended to be adapted to each institutions circumstances and. Isolated or Technical Regulatory Violations. The Bank Secrecy Act and its promulgating regulations require banks to identify risks assess the risks and create a compliance program based on the risk assessment.

DSC Risk Management Manual of Examination Policies 81-3 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 More than one of these factors must typically be present in order to provide sufficient evidence that the corporate veil has been pierced. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. The FFIEC Bank Secrecy Act Anti-Money Laundering Examination Manual further states there are many effective methods and formats used in completing a BSAAML Risk Assessment and that credit union management should decide the appropriate method and format.

Exam Prep for Risk Based Exams. BSAAML RISK ASSESSMENT EXAMINATION PROCEDURES. Community Bank Secrecy Act Risk Assessment Software bSAComply Support Your Anti-Money Laundering Programs.

Should our risk assessment include products and services we dont offer. For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. Risk Assessment Prep.

Determine the adequacy of the banks BSAAML risk assessment process and determine whether the bank has adequately identified the ML TF and other illicit financial activity risks within its banking operations. CSBS and a group of state BSAAML subject-matter experts developed the BSAAML Self-Assessment Tool to be used at the discretion of a financial institution to help in the BSAAML risk assessment process. Bank Secrecy Act Total Official Checks including Travelers Cashier Checks Compliance Testing Operational Testing Last Tested Year Freq.

BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved. To meet compliance requirements banks and credit unions must implement effective anti-money laundering programs supported by comprehensive assessments of riskbSAComply provides the framework to develop the required assessments of BSA OFAC and. Bank Secrecy ActAnti-Money Laundering Self-Assessment Tool.

Section provides information and procedures for examiners in determining whether the bank has developed a risk assessment process that adequately identifies the MLTF and other illicit financial activity risks within its banking operations. 200 Has the credit union received correspondence from law. Banks have a responsibility to monitor identify and report suspicious activity If made aware of unusual or suspicious activity a bank must investigate to determine if a SAR should be filed Banks are not responsible for finding evidence or proving crime.

Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk. When the Federal Banking Regulators started to focus on this risk-based approach in 2005 this is the focus of all regulators now the FIs started documenting their Bank Secrecy ActAnti-Money Laundering BSAAML Risk Assessments. Bank Secrecy Act Office of Foreign Assets Control This guidance covers supervisory matters involving the anti-money laundering AML programs of banking organizations supervised by the Federal Reserve including their compliance with the Bank Secrecy Act BSA suspicious activities and current transaction reporting and the USA PATRIOT Act.

The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign Transactions. Could isolated or technical exam findings results in a regulatory enforcement action. Overall Bank Secrecy Act and Anti-Money Laundering Risk Assessment Score High 61 to 75 Moderate 41 to 60 Low 25 to 40 31 HIDTAHIFCA High Intensity Drug Trafficking Area and High Intensity Financial Crime Area.

We are a small low risk financial institutions. The Self-Assessment Tool is designed to support banks communicate the results of this risk assessment process.

What Is The Model Risk In A Risk Assessment Acams Today

Https Indianabankers Org Sites Default Files Events Files Part 203 20bsa 20grad 20sch 20 20risk 20assess 20iba 20final 202017 Pdf

Bsa Aml Ofac Staff Training Ppt Download

Line Of Business Aml Policies And Procedures Ppt Video Online Download

Https Www Csbs Org Sites Default Files 2017 11 Csbs 20bsa Aml 20self Assessment 20tool 20introduction 20and 20instructions 20final Pdf

Monitoring High Risk Transactions

Bank Secrecy Act Bsa Anti Money Laundering

Breaking Down The Bsa Aml Risk Assessment Review Capital Compliance Experts

Monitoring High Risk Transactions

Bsa Aml Risk Assessments And The Bank Secrecy Act Freed Maxick

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Https Dfi Wa Gov Documents Credit Unions Compliance Manual Bsa Overview Pdf

Https Www Csbs Org Sites Default Files 2017 11 Csbs 20bsa Aml 20self Assessment 20tool 20introduction 20and 20instructions 20final Pdf

Bsa Ofac Risk Assessment The New Norm Ppt Download

The world of rules can appear to be a bowl of alphabet soup at instances. US cash laundering rules are no exception. We have compiled a list of the top ten money laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending monetary companies by reducing threat, fraud and losses. We've big financial institution expertise in operational and regulatory risk. We now have a powerful background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many opposed consequences to the organization due to the dangers it presents. It increases the chance of main dangers and the chance value of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment